7 Easy Facts About Transaction Advisory Services Described

Wiki Article

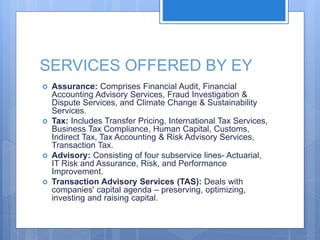

Some Known Details About Transaction Advisory Services

Table of ContentsNot known Details About Transaction Advisory Services Transaction Advisory Services Can Be Fun For Anyone5 Easy Facts About Transaction Advisory Services ExplainedTransaction Advisory Services - The FactsThe Definitive Guide for Transaction Advisory Services

This action makes certain the service looks its best to possible buyers. Getting the organization's value right is vital for a successful sale.Purchase advisors action in to help by getting all the needed information arranged, addressing concerns from buyers, and organizing visits to the organization's area. Deal advisors utilize their know-how to help company proprietors take care of hard arrangements, fulfill purchaser expectations, and framework bargains that match the proprietor's objectives.

Fulfilling lawful rules is vital in any kind of company sale. Deal consultatory solutions deal with legal experts to develop and assess agreements, contracts, and various other lawful documents. This decreases risks and sees to it the sale complies with the regulation. The role of purchase experts prolongs past the sale. They help company owner in preparing for their next steps, whether it's retired life, beginning a new endeavor, or handling their newfound wide range.

Transaction experts bring a wealth of experience and expertise, making sure that every facet of the sale is dealt with skillfully. Through tactical prep work, assessment, and negotiation, TAS helps company owner accomplish the greatest feasible sale rate. By making sure legal and regulative compliance and handling due persistance together with other offer employee, purchase consultants reduce potential threats and obligations.

Some Known Facts About Transaction Advisory Services.

By contrast, Huge 4 TS teams: Service (e.g., when a potential purchaser is conducting due persistance, or when a bargain is shutting and the customer needs to incorporate the business and re-value the vendor's Annual report). Are with fees that are not linked to the offer closing successfully. Make costs per engagement someplace in the, which is less than what financial investment financial institutions gain even on "small bargains" (but the collection chance is also a lot greater).

The meeting inquiries are extremely comparable to financial investment banking meeting questions, however they'll focus more on accountancy and appraisal and less on subjects like LBO modeling. For instance, expect concerns about what the Change in Capital ways, EBIT vs. EBITDA vs. Earnings, and "accountant just" subjects like test balances and just how to go through events utilizing debits and credit reports as opposed to economic declaration changes.

Transaction Advisory Services for Beginners

Experts in the TS/ FDD groups might also interview administration regarding everything above, and they'll compose an in-depth report with their findings at the end of the process., and the basic form looks like this: The entry-level duty, where you do a whole lot of information and financial evaluation (2 years for a promotion from below). The following degree up; comparable work, yet you get the even more interesting bits (3 years for a promo).

Particularly, it's hard to get promoted beyond the Manager level since few individuals leave the job at that phase, and you need to begin revealing proof of your ability to generate income to development. Let's begin with the hours and lifestyle given that those are much easier to define:. There are periodic late nights and weekend work, yet absolutely nothing like the frantic nature of financial investment financial.

There are cost-of-living adjustments, so expect lower compensation if you're in a cheaper area my website outside major monetary (Transaction Advisory Services). For all placements except Companion, the base pay consists of the mass of the overall compensation; the year-end benefit could be a max of 30% of your base salary. Frequently, the very best method to boost your incomes is to change to a different firm and work out article source for a greater income and incentive

8 Easy Facts About Transaction Advisory Services Shown

You can enter business growth, but investment financial obtains more hard at this phase because you'll be over-qualified for Analyst functions. Business finance is still an alternative. At this stage, you ought to simply stay and make a run for a Partner-level role. If you intend to leave, maybe transfer to a customer and perform their valuations and due persistance in-house.The main issue is that since: You usually require to join one more Large 4 team, such as audit, and job there for a couple of years and afterwards relocate into TS, work there for a few years and afterwards relocate into IB. And there's still no guarantee of winning this IB function since it depends on your area, customers, and the working with market at the time.

Longer-term, there is additionally some threat of and since reviewing a company's historic monetary details is not specifically rocket scientific research. Yes, humans will certainly always need to be involved, however with even more innovative technology, lower head counts might possibly sustain client involvements. That claimed, over here the Transaction Services team beats audit in terms of pay, job, and departure possibilities.

If you liked this post, you may be interested in analysis.

Some Known Factual Statements About Transaction Advisory Services

Establish innovative financial frameworks that assist in figuring out the actual market price of a firm. Supply advising operate in relation to business evaluation to assist in negotiating and pricing frameworks. Discuss the most appropriate type of the deal and the sort of factor to consider to employ (cash money, stock, gain out, and others).

Perform integration planning to identify the process, system, and organizational modifications that may be needed after the deal. Set standards for integrating departments, modern technologies, and service procedures.

Assess the possible consumer base, market verticals, and sales cycle. The operational due diligence supplies crucial insights right into the performance of the company to be gotten worrying risk assessment and value production.

Report this wiki page